Scoring and evaluating capital expenditure (CapEx) investment opportunities can be a systematic process that helps prioritise and enables you to make informed decisions. Whilst the “best” method may vary depending on your organisation’s needs and goals, the following steps can guide you in creating an effective scoring and evaluation system:

- Define Evaluation Criteria:

Start by defining clear and specific criteria that align with your organisation’s goals and strategic objectives. These criteria can be financial and non-financial. Examples include ROI (return on investment), NPV (net present value), IRR (internal rate of return), strategic alignment, risk, market potential, and environmental impact. - Weight the Criteria:

Assign weights to each criterion based on its importance. The weights should reflect the relative significance of each criterion in the decision-making process. Financial criteria like ROI may carry more weight than non-financial criteria like environmental impact, for example. - Develop a Scoring System:

Create a scoring system, typically on a scale (e.g., 1-10), for each criterion. This system allows you to quantify how well each investment opportunity performs against the criteria. - Data Collection and Analysis:

Collect data and conduct a thorough analysis of each investment opportunity against the established criteria. This may involve financial modelling, market research, risk assessment, and other relevant analyses. - Score Each Opportunity:

Score each investment opportunity against each criterion based on the data and analysis. Multiply the scores by the assigned weights for each criterion. - Calculate the Total Score:

Calculate the total score for each investment opportunity by summing the weighted scores for all criteria. This total score provides an overall assessment of the investment’s quality. - Rank and Prioritise:

Rank the investment opportunities based on their total scores. Opportunities with higher scores are considered more attractive and should be prioritised. - Scenario Analysis:

Conduct scenario analysis to assess how changes in key variables (e.g., revenue, cost, interest rates) impact the investment opportunities. This helps account for uncertainty and risk. - Sensitivity Analysis:

Perform sensitivity analysis to understand how changes in individual criteria might affect the rankings. This helps identify which criteria have the most significant impact on the decision. - Decision-Making:

Make informed decisions based on the rankings and prioritisation. Consider budget constraints and the availability of resources when selecting which investments to pursue. - Review and Update:

Periodically review and update the scoring system and criteria to ensure it remains aligned with the organisation’s evolving goals and market conditions. - Documentation:

Document the evaluation process and the rationale behind the rankings. This documentation is essential for transparency and future reference. - Stakeholder Involvement:

Involve relevant stakeholders, such as finance, operations, and strategy teams, in the evaluation process to gain different perspectives and expertise.

Remember that the scoring and evaluation process should be flexible and adaptable to the specific needs of your organisation and the nature of the investment opportunities. Regularly assessing and refining your evaluation system ensures that it continues to serve as an effective tool for decision-making.

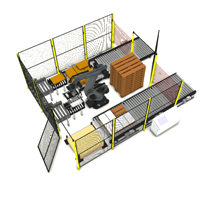

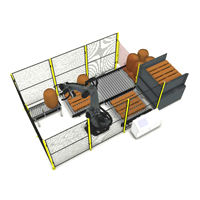

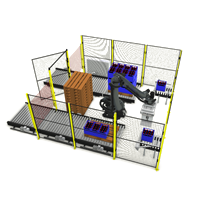

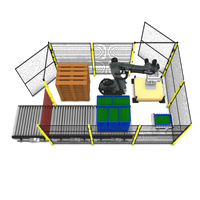

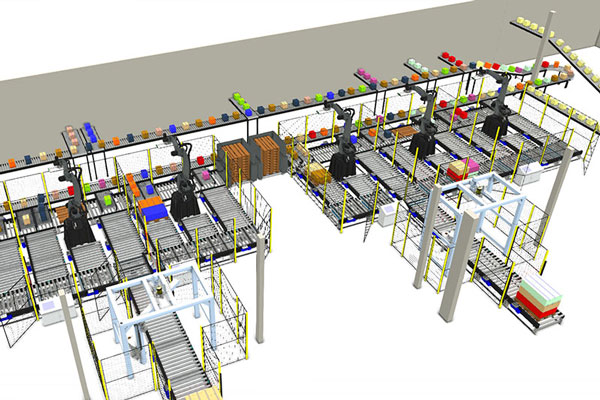

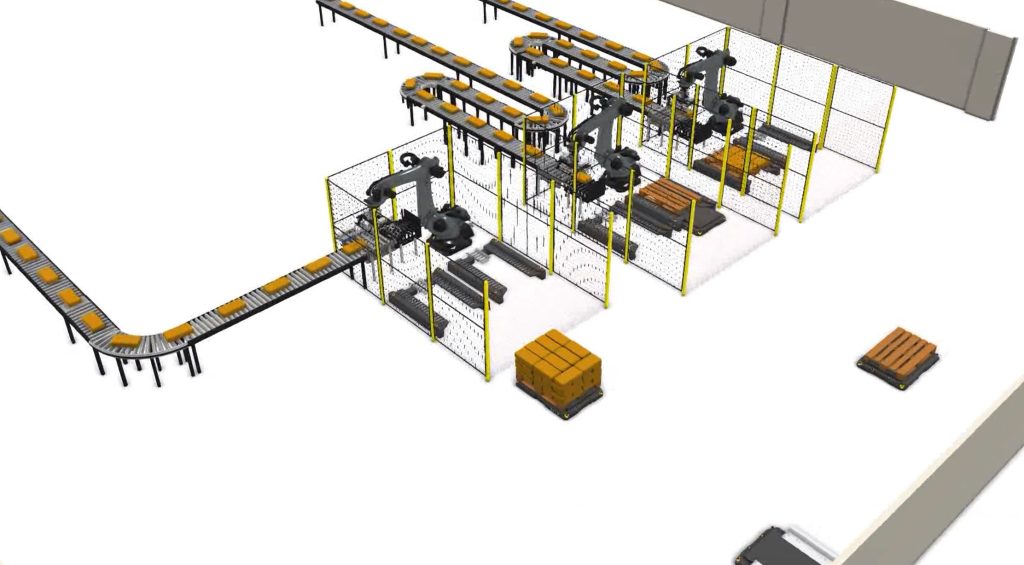

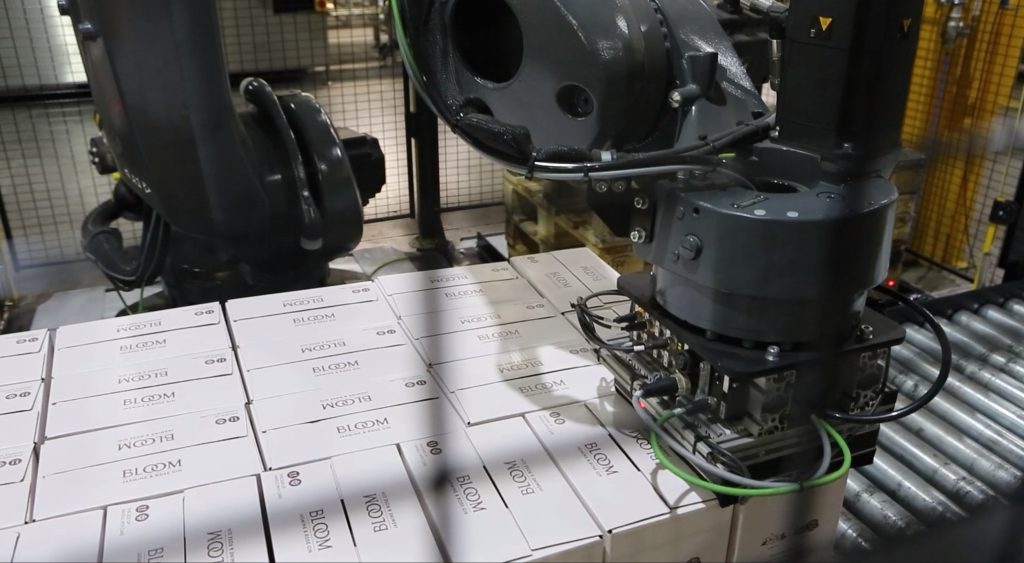

We have developed some downloadable tools for evaluating palletiser purchases which you may find useful as the same principles would apply to any CapEx investment.

- Automation payback calculator – click here to download

- Intangible benefits calculator – click here to download

If you are looking to invest in a palletising system and would like more information then please contact us on 01223 499488 or helpline@granta-automation.co.uk and we will be very happy to help.

Find out more…

- What Stops A Palletiser From Starting If Someone Is In The Cell?

- Can A Palletiser Be Purchased as OpEx rather than CapEx?

- How Often Do Palletisers Break Down?

- How Easy Is ‘Easy Programming’ Palletiser Software? How Does It Differ To Traditional Palletisers?

- Robotic Palletiser vs Layer Former Palletiser