Strategic planning for capital expenditure is a cornerstone of success. For managers responsible for overseeing capital expenditures (CapEx), the stakes are high. Capital investments are often substantial, and their success hinges on the ability to align them with the company’s long-term goals while staying responsive to market dynamics. A robust approach to strategic CapEx planning ensures that financial resources are allocated wisely, delivering sustainable value that positions the business for future growth.

This article provides a comprehensive look into two vital pillars of effective CapEx strategy: Long-Term Planning and Market Analysis. Together, these elements create a framework for making well-informed capital investment decisions that align with strategic objectives while anticipating changes in market conditions.

1. Long-Term Planning: Aligning Capital Expenditures with Strategic Goals

At its core, capital expenditure is about making investments that support a company’s growth and operational efficiency. However, the real value of CapEx lies in its ability to drive long-term progress. Companies that excel in CapEx management recognise the need to align their capital investment strategy with their broader business objectives. This process goes beyond solving immediate operational challenges and focuses on building a foundation for sustainable growth and innovation.

Why Long-Term Planning is Essential for CapEx Success

- Strategic Investment Decisions: Long-term planning enables managers to evaluate capital investments based on their potential to move the organisation closer to its long-term vision. For example, investing in advanced manufacturing technologies may not yield immediate gains, but it could reduce costs and boost productivity over the next decade. Similarly, investing in digital transformation initiatives may streamline operations, enhance customer engagement, and open up new revenue streams in the future.

- Sustainable Competitive Advantage: Companies that focus solely on short-term needs risk falling behind their competitors. Long-term CapEx planning allows businesses to stay ahead of the curve by investing in areas that will offer a sustainable competitive advantage. For example, by adopting cutting-edge technologies or expanding into high-growth markets, businesses can establish a leadership position that others struggle to match.

- Future-Proofing Operations: Rapid technological advances, evolving customer expectations, and shifts in regulatory requirements all present challenges to businesses. By investing with a long-term perspective, companies can future-proof their operations, ensuring that they remain agile and adaptable in the face of change. This might involve investing in scalable technologies, sustainable practices, or workforce development initiatives that align with future business needs.

Key Steps for Aligning CapEx with Strategic Goals

- Understanding the Corporate Vision: As a manager, your first step is to have a clear understanding of the company’s long-term vision and strategic goals. Whether it’s entering new markets, expanding product offerings, or enhancing customer experiences, knowing the direction of the company allows you to make CapEx decisions that actively support these objectives.

- Prioritising Strategic Investments: Once the long-term vision is clear, the next step is to prioritise investments. Not all capital expenditures are equal, and it’s crucial to identify those that will provide the greatest long-term benefit. For instance, investing in research and development (R&D) may foster innovation, whereas upgrading outdated IT infrastructure may enhance operational efficiency. Managers must weigh these potential benefits against available resources to determine which projects align most closely with strategic priorities.

- Cross-Functional Collaboration: Capital expenditure decisions often require input from multiple departments, such as finance, operations, and IT. Collaborative planning ensures that all perspectives are considered, helping to identify potential synergies and ensuring that investments are well-coordinated across the organisation. For instance, an IT investment in automation could significantly impact operational workflows, requiring input from HR and operations to ensure a smooth transition.

- Dynamic, Ongoing Evaluation: Long-term planning does not mean rigid planning. Business environments are fluid, and strategies must evolve in response to new market realities, technological advancements, and changing customer expectations. Regular reviews of capital expenditure plans allow managers to adjust priorities, phase out obsolete projects, and reallocate resources to emerging opportunities.

2. Market Analysis: Understanding Trends to Guide CapEx Decisions

The global business landscape is continuously shaped by changing economic conditions, technological innovations, and shifting customer demands. Successful CapEx planning cannot be done in isolation; it requires a deep understanding of market trends and competitive dynamics. Market analysis plays a crucial role in guiding capital investment decisions, helping managers identify opportunities for growth while mitigating potential risks.

How Market Analysis Influences Strategic CapEx Planning

- Capitalising on Emerging Opportunities: One of the most critical functions of market analysis is to identify growth opportunities before they become mainstream. For example, in recent years, companies that invested early in digital transformation, AI, or renewable energy have reaped significant benefits. Market analysis helps managers recognise these trends early, allowing for strategic capital investments that position the business for growth in emerging sectors.

- Anticipating Market Shifts: No market remains static, and companies that fail to anticipate change risk becoming obsolete. Comprehensive market analysis can reveal shifts in consumer preferences, economic conditions, or regulatory environments that may affect future business performance. For instance, if a company anticipates stricter environmental regulations, it can pre-emptively invest in sustainable technologies to stay ahead of the regulatory curve.

- Competitor Benchmarking: Staying informed about competitors’ CapEx decisions is essential. Competitive analysis allows managers to assess whether their own investment strategies are keeping pace with the market or lagging behind. For example, if competitors are making aggressive investments in automation, it may signal the need for your company to consider similar investments to maintain operational efficiency and cost competitiveness.

Conducting Effective Market Analysis for CapEx Planning

- Tracking Industry Trends: To make informed capital investment decisions, managers must actively monitor industry-specific trends. This could include technological advancements, economic forecasts, shifts in consumer behaviour, or regulatory changes. For example, the rise of electric vehicles has prompted companies in the automotive supply chain to invest in related technologies. By staying on top of such trends, companies can make CapEx decisions that align with the future direction of the industry.

- Engaging with Customers and Stakeholders: CapEx decisions should be customer-centric. By understanding what customers value and how their needs are evolving, managers can invest in areas that enhance customer satisfaction and loyalty. Whether this means investing in faster delivery systems, personalised product offerings, or new service channels, a customer-focused CapEx strategy can lead to long-term competitive advantages.

- Analysing the Competitive Landscape: A thorough analysis of competitors can help identify where they are allocating their capital and whether similar investments are necessary for your business. However, blindly following competitors isn’t always the best strategy. Managers must critically assess whether mimicking competitor strategies aligns with their company’s long-term goals or whether they should forge their own path by identifying unexploited niches.

- Staying Ahead of Regulatory Changes: The regulatory environment plays a significant role in shaping capital expenditure decisions, particularly in highly regulated industries such as healthcare, energy, and finance. By closely monitoring policy changes, companies can invest in compliance-related upgrades early, avoiding costly penalties or operational disruptions in the future.

Conclusion: Integrating Long-Term Planning and Market Insights for CapEx Excellence

In the dynamic world of business, capital expenditure planning is much more than budgeting for new equipment or facilities—it is a strategic tool for driving long-term success. By carefully aligning CapEx decisions with the company’s long-term goals and thoroughly understanding market trends, managers can create a forward-looking CapEx strategy that maximises value and ensures the company remains competitive and innovative.

Long-term planning ensures that capital investments are closely tied to the company’s strategic vision, while market analysis provides the insights needed to adapt to emerging opportunities and potential risks. When combined, these two pillars of CapEx strategy enable companies to make thoughtful, informed decisions that position them for sustainable growth and success in a rapidly changing world.

For managers, the ability to navigate this complex landscape with precision is critical. Strategic CapEx planning isn’t just about ensuring the smooth day-to-day operation of the business—it’s about building a resilient, future-ready organisation capable of thriving in any environment.

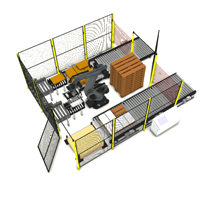

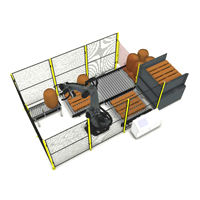

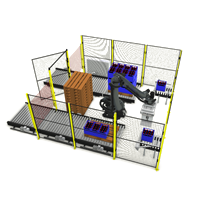

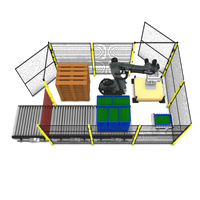

If you would like to know more about the Granta palletising systems or AMR/AGV systems, then please do get in touch on 01223 499488 or contact us at helpline@granta-automation.co.uk. We will be very happy to help.

Find out more…

- Ways To Speed Up The Palletising Process In Production

- How To Automate Cross Palletising and Depalletising from UK to Euro Pallets

- How Cycle Time Reduction Improves Operational Efficiency

- Autonomous Mobile Robot (AMR) Pallet Stations, Charging Stations, and Conveyor Stations

- Mastering Budget Planning: Advanced Methods for Planning and Allocating Capital Budgets in Manufacturing

Warning: Undefined variable $aria_req in /var/www/granta-automation.co.uk/news/wp-content/themes/twentyten/comments.php on line 81

Warning: Undefined variable $aria_req in /var/www/granta-automation.co.uk/news/wp-content/themes/twentyten/comments.php on line 86