The UK governments Super-deduction scheme is one of the most attractive tax incentives for business investment that has ever been offered by the UK Government. The scheme has been created to encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow, and to encourage them to make those investments now.

For capital expenditure incurred from 1st April 2021 until the end of March 2023, companies can claim 130% capital allowances on qualifying plant and machinery investments. It allows companies to cut their tax bill by up to 25p for every £1 they invest.

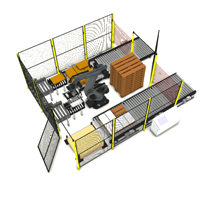

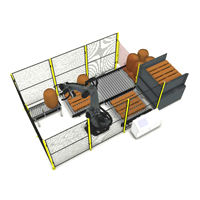

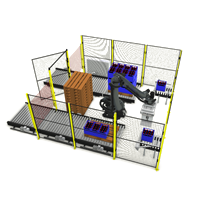

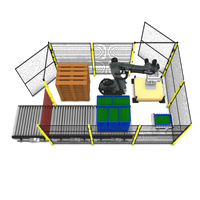

Below is a worked example showing what the tax benefit to you would likely be when purchasing a palletising system.

| Super-Deduction Scheme Worked Example |

|

Taking advantage of the Governments Super-deduction scheme will effectively enable you to purchase a £100,000 palletising system for as little as £75,300.

Full details of the scheme are available on the UK government website at https://www.gov.uk/guidance/super-deduction . Please check with your accountants to confirm the extent to which you can benefit from this scheme in your particular circumstances.

If you would like to know more about the Granta GA15 palletising system, feel free to get in touch on 01223 499488 or helpline@granta-automation.co.uk and we will be very happy to help.